Mortgage Foreclosures and the 30-40 year Mortgages Prompts Architectural Design Firm to Rethink the Future of Homes

Mortgage Foreclosures and the 30-40 year Mortgages Prompts Architectural Design Firm to Rethink the Future of Homes

As homeowners, we all have had felt the devastating effects of the real estate boom and bust or the economic collapse which has the most negative effect on our home mortgage and our income. That said, when there is a real estate Boom BUST or an economic collapse, which historically in the USA has happened every 7-10 years for the last 100 years, then one really needs to consider what a conventional banking mortgage really is. Well, the first 10 years of a mortgage is an interest only payment. What that means is that during the real estate BUST everyone always falls into that 10 year interest only mortgage and the principal is still 100% unpaid. This means you have 1, 2, or 3 choices.

1) The bank may ask you to pay the upside down side of the loan immediately. So let’s talk about luxury homes, as this happens more than people realize. You may have a $5M home you purchased a few years ago, and all of a sudden someone says there is a real estate BUST or an economic collapse. They (the bank) says your home is only worth $3M today, and you need to cough up $2M to make the loan even for the bank. If you can’t make that $2M payment, then they actually take your $5M home away from you and your life is ruined. Does this sound right? Seems a little unfair, wouldn’t you say?

2) The second option is: you could, if lucky, you can try to get a refinance of your home with another bank and start your mortgage all over again. What? That means your 30 year mortgage is now a 40 year mortgage, and if this cycle continues as it has every 7-10 years, you simply have a lifetime mortgage and never own your home without a mortgage or debt attached to it. Does this sound ideal to a home owner? I’m not sure about having a lifetime mortgage. Does that mean I can never retire? Does it mean I need a job for my entire lifetime? Will I have a good paying job to afford the mortgage in 5 years, 10 years or even 20 years? Can we even think out to 30 years? Probably not!

3) The worst of the 3 options is that when your house is up-side down, the bank tells you that you are 3 payments behind and it’s time to foreclose on your dream home. The only option now is to live on the street, or move in with your parents or some family member who may be willing to help you but will always blame you for your circumstances or say you’re a loser. Does this feel right? Wait, you’re the home owner, had nothing to do with the real estate Boom & BUST and economic collapse! Why are you being blamed for this mortgage crisis and foreclosure? The answers have always been the same, and really it’s not something any homeowner can control.. UNTIL NOW!

Requirements

To Get a Mortgage | Conventional Home

Banking Mortgage | The Bitcoin House

Bitcoin Mortgage | |

| | | No Credit Report needed with the Bitcoin House |

| | | No Credit Score needed with the Bitcoin House |

| | | No Application to qualify needed with the Bitcoin House |

| | | Bitcoin House requires a 50% down payment, No Job is required |

| | | Conventional Mortgage vs Bitcoin Mortgage |

| | | Bitcoin Mortgage has an accelerated mortgage payment via it's mining earnings |

| | | No Mortgage payments with Bitcoin valued at $6,000 or higher |

Pays You to LIVE in your Home | | | The Bitcoin House pays you $100k per month to live in your home (ask how) |

Down Payment To Buy the Home | | | 50% Down & home owner has no payments, payments are made by Bitcoin miners |

| | | You own the Bitcoin mining operation so you earn the procceeds every day |

What Happens after Mortgage is paid OFF? | | | Banks control the Bubble so that they can foreclose on your home before the payoff |

| | | Your Bitcoin house is an income generator not a debt generator |

| | | You're in control with the Bitcoin Mortgage not the Banks |

| | | |

So we’ve analyzed how the 30 year home mortgage works, and believe me after having 4 mortgages in my lifetime, it’s so easy to see that the mortgage is not designed for the home owner, it’s a huge money maker for the bankers and no one else. So how do we turn this around? Well as a home owner one needs to understand that being a bank gives you some huge privileges and this is what separates the common man from a bank.

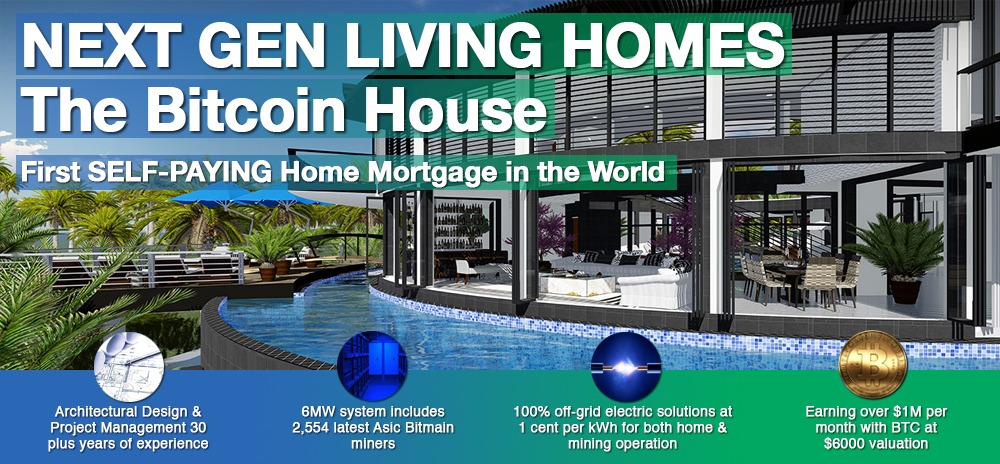

What if you could become the bank and then have your bank make all the payments for you without working, without a credit report, or even a credit check. This is where out of the box thinking comes into play. We all know that robotics and computers are all taking our jobs away and replacing many high earning people’s wages. So it seems that this technology craze is really what needs to be investigated as to how we can turn the tables and use robotics and computers to our advantage to earn an income, but even better–to pay the mortgage and work for us 24 hours a day, 7 days a week and 365 days a year non stop, instead of people working. In fact, let’s make this technology also pay us to live in our home. Would life be sweeter and more enjoyable? Imagine now you have no mortgage payments and you’re paid a salary that most people never see in a lifetime. How about being paid $100k per month to live in your home? That’s a cool $1.2M per year! Can you live with that income and know you have no mortgage payments ever? You’re probably thinking this is science fiction, or that I’m dreaming or that it’s too good to be true. WELL ACTUALLY IT’S REAL! We’ve come up with the master plan that does exactly that with 50% as a down payment on our Flag Ship Home namely the Bitcoin House, which offers a Bitcoin Mortgage, it’s all possible. Here’s quick chart to compare a conventional mortgage vs a Bitcoin mortgage. Check it out and reserve your home now.

At this time this offering is ONLY for the Bitcoin House, but we anticipate that in the next 5-10 years we can offer this exclusive Bitcoin Mortgage to all homeowners worldwide. As proof of concept we’ve done all the numbers and calculations (

see spreadsheets here), which allows a homeowner to pay off their mortgage at an accelerated pace of 3-10 years based on the value of Bitcoin. So as the Bitcoin value goes up, so does the accelerated mortgage payment, and thereby paying off a HUGE mortgage in short order.

Did we mention what happens after the Bitcoin Mortgage is paid off? Well this is the best part of owning the Bitcoin House. After the mortgage is paid off, the Bitcoin bank is still earning a cool $1M+ per month, which now goes into the homeowner’s pocket. So what’s the real value of the Bitcoin house? While a conventional mortgage is based on DEBT, the Bitcoin house is based on INCOME value. Will the Bitcoin House ever fall into a real estate BUST or an economic collapse? More than likely no, because of its income earnings and short pay-off period.

Have questions? Drop us a line here.